Trust Foundation Stability: Structure Trust in Every Project

Trust Foundation Stability: Structure Trust in Every Project

Blog Article

Reinforce Your Legacy With Specialist Trust Foundation Solutions

Professional count on foundation solutions offer a durable structure that can secure your possessions and ensure your wishes are carried out precisely as planned. As we dive right into the nuances of trust structure remedies, we reveal the vital components that can strengthen your legacy and give a long-term effect for generations to come.

Benefits of Trust Structure Solutions

Trust fund foundation options offer a robust structure for protecting assets and ensuring long-lasting financial safety for people and organizations alike. One of the main benefits of count on structure options is asset security.

In addition, count on foundation options provide a critical method to estate preparation. Via trusts, individuals can detail just how their properties should be handled and dispersed upon their passing away. This not only helps to prevent disputes amongst recipients but likewise makes certain that the person's heritage is managed and managed effectively. Counts on additionally offer privacy benefits, as possessions held within a trust fund are exempt to probate, which is a public and commonly extensive lawful procedure.

Sorts Of Counts On for Legacy Planning

When thinking about tradition planning, an important element includes checking out various types of lawful tools designed to preserve and disperse properties successfully. One typical sort of trust used in legacy preparation is a revocable living depend on. This depend on enables individuals to preserve control over their assets during their life time while making certain a smooth change of these assets to beneficiaries upon their passing, staying clear of the probate procedure and offering privacy to the family members.

Philanthropic trusts are additionally popular for people looking to sustain a cause while maintaining a stream of earnings for themselves or their beneficiaries. Unique demands trusts are essential for individuals with disabilities to ensure they receive needed treatment and assistance without jeopardizing government benefits.

Comprehending the various kinds of counts on offered for heritage planning is essential in establishing a thorough technique that straightens with individual objectives and top priorities.

Choosing the Right Trustee

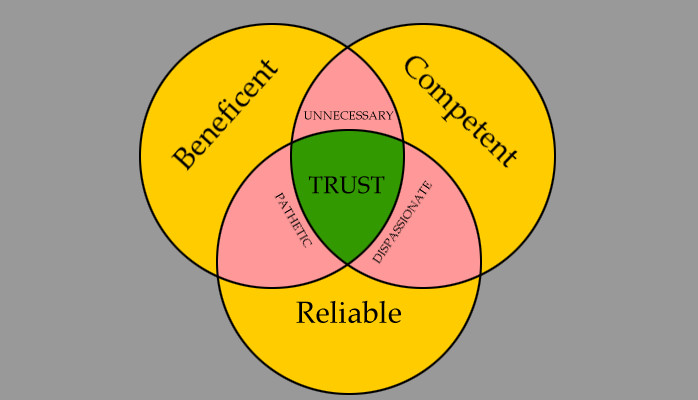

In the realm of legacy planning, an important aspect that demands careful consideration is the selection of a suitable individual to meet the essential function of trustee. Picking the right trustee is a decision that can considerably affect the effective implementation of a depend on and the satisfaction of the grantor's desires. When choosing a trustee, it is important to focus on top qualities such as dependability, financial acumen, honesty, and anchor a dedication to acting in the ideal passions of the recipients.

Ideally, the selected trustee needs to have a solid understanding of monetary issues, be qualified of making sound financial investment choices, and have the capability to browse intricate legal and tax obligation requirements. By thoroughly taking into consideration these factors and choosing a trustee who straightens with the worths and objectives of the count on, you can aid guarantee the lasting success and conservation of your legacy.

Tax Implications and Advantages

Considering the financial landscape surrounding depend on structures and estate preparation, it is critical to explore the complex world of tax ramifications and benefits - trust foundations. When establishing a count on, comprehending the tax ramifications is vital for enhancing the advantages and minimizing potential liabilities. Trusts provide various tax advantages relying on their next framework and objective, such as minimizing inheritance tax, revenue tax obligations, and present taxes

One significant advantage of particular trust fund frameworks is the capacity to transfer properties to recipients with minimized tax repercussions. Irreversible counts on can remove assets from the grantor's estate, possibly reducing estate tax liability. In addition, some depends on allow for income to be dispersed to beneficiaries, who might be in lower tax obligation braces, resulting in total tax obligation financial savings for the family members.

Nevertheless, it is necessary to keep in mind that tax obligation laws are complex and subject to alter, stressing the requirement of consulting with tax obligation professionals find out this here and estate preparation experts to make certain compliance and make the most of the tax obligation benefits of depend on foundations. Effectively navigating the tax ramifications of counts on can cause considerable savings and a much more effective transfer of wide range to future generations.

Actions to Developing a Count On

To develop a depend on efficiently, meticulous interest to detail and adherence to lawful procedures are essential. The primary step in establishing a trust is to clearly specify the objective of the trust and the possessions that will certainly be consisted of. This involves determining the recipients who will certainly gain from the trust and designating a reliable trustee to take care of the assets. Next, it is vital to pick the sort of count on that finest straightens with your goals, whether it be a revocable count on, irreversible trust fund, or living trust fund.

Verdict

To conclude, establishing a count on foundation can provide numerous advantages for heritage preparation, including property security, control over distribution, and tax obligation benefits. By selecting the ideal kind of depend on and trustee, individuals can guard their properties and ensure their wishes are executed according to their wishes. Understanding the tax obligation ramifications and taking the required actions to develop a count on can assist strengthen your heritage for future generations.

Report this page